This project was completed as part of the JP Morgan Chase job simulation on The Forage platform. In this case, a bank client tasked me with building a model to predict the probability of loan defaults based on customer characteristics such as income, loan amount, and years of employment. I conducted a thorough analysis of the provided customer dataset and then developed a predictive model.

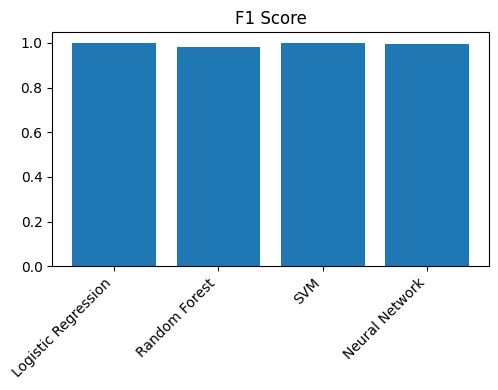

To build the model, I used multiple machine learning algorithms, including Logistic Regression, Random Forest, Support Vector Machine (SVM), and Neural Networks. All the models demonstrated strong performance, with the highest F1 score achieved by both SVM and Logistic Regression (0.9973).

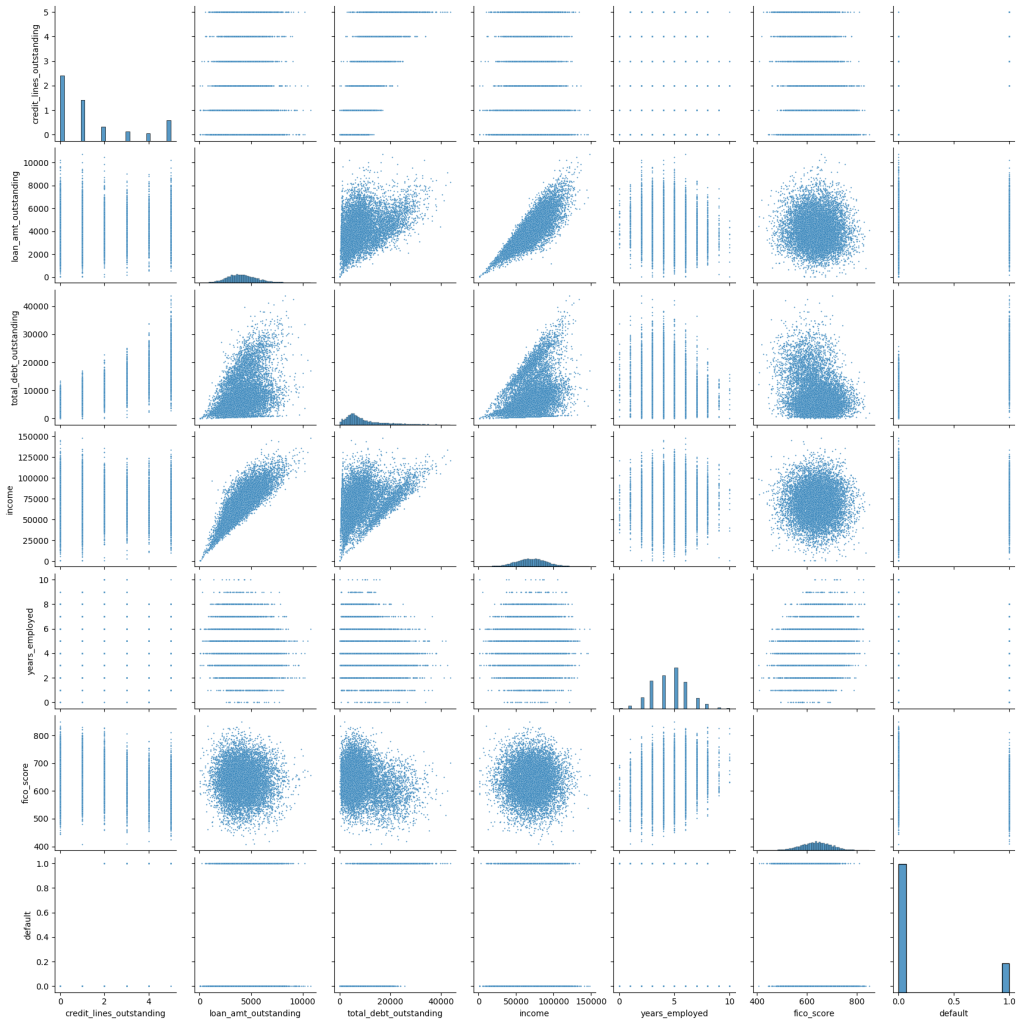

The tools and libraries used in this project include Python, Pandas, Seaborn, Matplotlib, and scikit-learn. The visualized dataset and model performance results can be found below. You can access the code here, and the certificate of completion for the job simulation is available here.

Cover photo by Andrea Piacquadio