This project was completed as part of the JP Morgan Chase job simulation on The Forage platform. A fictional commodities trading company approached us seeking to capitalize on natural gas price fluctuations to maximize profits. I was tasked with developing a price forecasting model using four years of historical data.

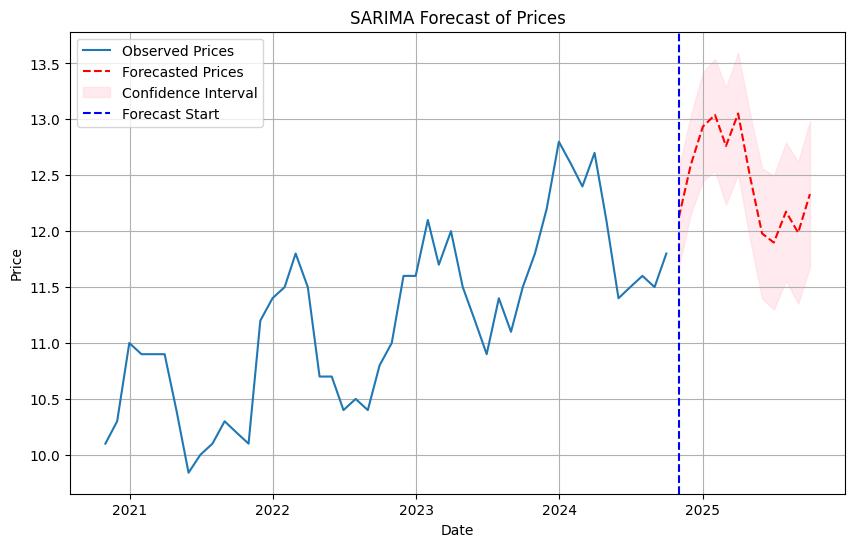

To achieve this, I utilized the SARIMA (Seasonal AutoRegressive Integrated Moving Average) model to generate a forecast for the upcoming year. The forecast result visualization is shown below.

The tools and libraries used in this project include Python, SARIMA, Pandas, Seaborn, Matplotlib, and Statsmodels. The full code for this analysis is available here, and the certificate of completion for this project can be found here.

Cover photo by Tom Fisk